Last summer's communications associate at Acumen, Emma Vaughn, kindly offered MBA students and job seekers "7 Tips to Landing a Job in Impact Investing," a list whose recommendations continue to provide valuable guidance in the search for a meaningful career in the field of impact investment.

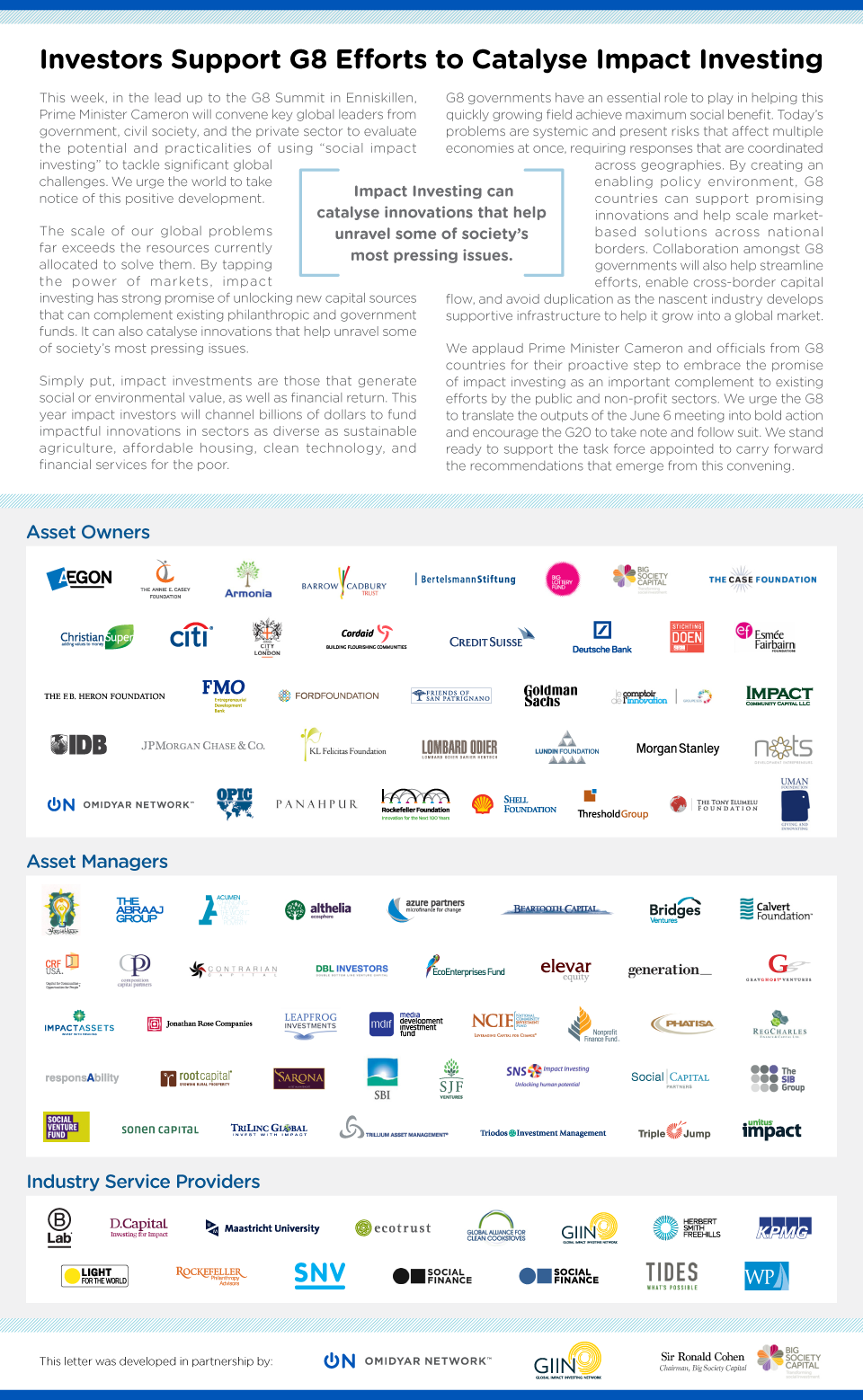

Sonen Capital supports the G8 Summit's efforts to catalyse impact investing. Prime Minister Cameron will convene global leaders from government, civil society and the private sector to evaluate potential and practicality of using "social impact investing".

Last spring, while preparing for a business case challenge, I learned about a new investment approach that blends social and environmental impact with financial return–Impact Investing. I happened to be part of a team that was trying to help scale Habitat for Humanity to help serve 50 million people in 10 years, and we were wrapping our minds around the problem: "how can we make sure there is capital for our solution?"

On March 20th, Presidio Presents featured a panel of entrepreneurs at the leading edge of impact investing in conversation with Presidio President and CEO, William Shutkin.

Helping smallholder farmers in Ghana get the best price for their crop. Encouraging sustainability-minded fish suppliers to create new products for the market. Collaborating with world-class biotech companies to develop vaccines for the developing world. While these are efforts that take place in the for-profit world, they are some of the strategies that foundations are beginning to embrace to pursue their charitable missions.

Author Jim Finkelstein says his son is worried about the future: and for good reason. The 21-year-old college graduate and member of the Millennial generation — those born between 1978 and 2000 — recently came across research concluding that, by 2050, global warming will have wrought calamitous changes on the planet. "We need to do something about it now," he told his dad over dinner.

From age ten, I was the oldest male in our household of six. Maybe for that reason, I have never liked submitting to authority; since I had to figure out how to do so many things myself, I resisted others telling me what to do. Though I have had many great bosses, mentors, and friends along the way (many of them described in this Gratitude series), I never had a coach until I met Tom Bird.

Sonen Capital and the impact investment business are logical fits for me. For a variety of political, socio-economic, and environmental reasons, the interplay between public and private finance is increasing. With no shortage of social challenges, and growing societal and investor interest in sustainability, impact investing is set to flourish.

The United States' wealth management industry is in the midst of a transition unlike anything it has ever seen. Over the next several decades, as baby boomers age and transfer their wealth to the next generation, an unprecedented $41 trillion will change hands, according to researchers from the Social Welfare Research Institute at Boston College, whose report focuses on the 55-year period between 1998 and 2052.

101 Montgomery Street

Suite #2150

San Francisco, CA 94104

+1 (415) 534-4444

info@sonencapital.com